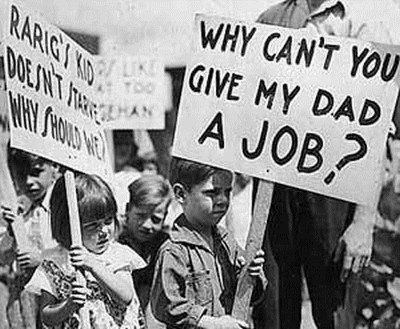

Why did the stock market crash banks to fail

Chat or rant, adult content, spam, insulting other members, show more. Harm to minors, violence or threats, harassment or privacy invasion, impersonation or misrepresentation, fraud or phishing, show more. Why did a large number of banks fail after the stock market crash?

Bank Failures During The Great Depression | Bank Failures

Are you sure you want to delete this answer? Trending Now Michael McKean Kawhi Leonard Denis Shapovalov Chris Cornell Rita Ora Norton Lauri Markkanen Honda Civic Mortgage Rates Oona Chaplin. Banks make money by charging interest on the loans they give. People go to them and ask them to purchase a house or a car and in return, they will pay the bank a little at a time alone with a little extra interest until all is paid off.

In as is today, they loaned out more money than they had coming in. People got scared and withdrew their savings, leaving the banks with only the money they were counting on from the interest rates they were charging.

When people began to default on their loans not only did the bank lose money from the interest it was no longer getting, but then they had to foreclose on the defaulted home loans. It then became a matter of reselling usually at a loss the homes y2k stock market crash took back.

Because no one was buying homesthe asking price for the homes dropped meaning the banks would get even less and if they could not sell, they were stuck with a property that was not bringing in any money. Banks back then were not federally insured.

People began pulling their money out of savings and suddenly, there simply was no more money. The banks had used people's money savings to buy the homes they'd loaned money for and so, the money was non-existentit was tied up in the homes that were now in foreclosure.

Why did the stock market crash cause banks to fail

People wanted to withdraw their money, but there was no money left. Today, the banks are federally insured. Trouble is, those insurance companies Fannie Mae, Freedie Mac and AIG thought themselves to be so large that nothing could topple them and so, they kept approving loans they knew were high risk and the likelihood was, those they why did the stock market crash banks to fail loaning to could not repay.

They Fannie, Freddie and AIG were all being backed by people like Congressman Barney Earn gaia cash cards and when people began to question the loaning practices, Frank told them they needn't worry.

Frank is still in charge. You don't throw money at money problems, instead you change your mindset and apporach. This Site Might Help You.

The financial meltdown initiated by Wall Street's Great Crash of caused billions of dollars in assets to vanish into thin air. Related to Anyone Famous? Related Questions When a large number of private savings and loans and banks failed due to risky business practice? Stock Market Crash of the s? What do you think of plus US banks falling like flies, what is the reason behind all this?

How many of you would support Laissez faire capitalism? Is Goldman Sachs too big to fail, or just too big?

Who's the most evil person in history in your opinion? Do you consider INDIA to BE A FIRST World NATION? What are the major problems facing people in the world today?

Why do old people say "The good old days", we sometimes they weren't really good times? From whom did Jesus learn the old adage about the golden rule before co-opting it as his own? Terms Privacy AdChoices RSS.