Intrinsic value short call option price

In finance , intrinsic value refers to the value of a company, stock , currency or product determined through fundamental analysis without reference to its market value. It is ordinarily calculated by summing the discounted future income generated by the asset to obtain the present value.

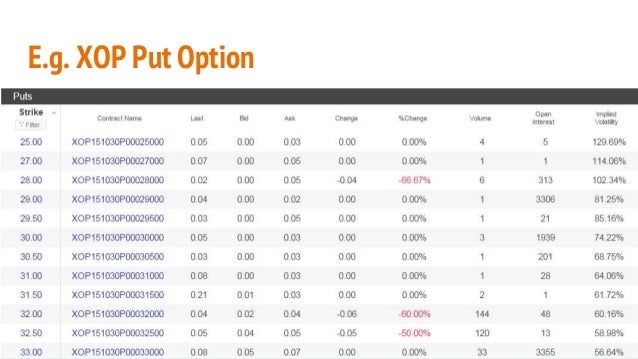

It is worthy to note that this term may have different meanings for different assets. An option is said to have intrinsic value if the option is in-the-money.

Option time value - Wikipedia

When out-of-the-money , its intrinsic value is zero. The intrinsic value for an in-the-money option is calculated as the absolute value of the difference between the current price S of the underlying and the strike price K of the option.

The value of an option is the sum of its intrinsic and its time value.

Stocks are assumed to be equity instruments because they are supposed to represent ownership [2] interest in the company. However, the 'equity' label is somewhat questionable.

Strike Price and Intrinsic Value of Put Options - Macroption

Class C [3] common stocks for example, do not have any voting rights or dividend privileges. They are still considered equity instruments by finance professionals, but shareholders are not entitled to the earnings of the underlying company and lack the right to voice an opinion. In valuing equity, securities analysts may use fundamental analysis —as opposed to technical analysis —to estimate the intrinsic value of a company.

Here the "intrinsic" characteristic considered is the expected cash flow production of the company in question. Intrinsic value is therefore defined to be the present value of all expected future net cash flows to the company; it is calculated via discounted cash flow valuation. This is not a proven theorem or a validated theory, but a general assumption.

An alternative, though related approach, is to view intrinsic value as the value of a business' ongoing operations, as opposed to its accounting based book value , or break-up value. Warren Buffett is known for his ability to calculate the intrinsic value of a business, and then buy that business when its price is at a discount to its intrinsic value. In valuing real estate , a similar approach may be used.

The "intrinsic value" of real estate is therefore defined as the net present value of all future net cash flows which are foregone by buying a piece of real estate instead of renting it in perpetuity. These cash flows would include rent, inflation, maintenance and property taxes. This calculation can be done using the Gordon model. From Wikipedia, the free encyclopedia. This article is about the valuation of financial assets.

For the philosophy of economic value, see Intrinsic theory of value. Retrieved 22 March Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility. Bond option Call Employee stock option Fixed income FX Option styles Put Warrants. Asian Barrier Basket Binary Chooser Cliquet Commodore Compound Forward start Interest rate Lookback Mountain range Rainbow Swaption.

Collar Covered call Fence Iron butterfly Iron condor Straddle Strangle Protective put Risk reversal. Back Bear Box Bull Butterfly Calendar Diagonal Intermarket Ratio Vertical.

Binomial Black Black—Scholes model Finite difference Garman-Kohlhagen Margrabe's formula Put—call parity Simulation Real options valuation Trinomial Vanna—Volga pricing. Amortising Asset Basis Conditional variance Constant maturity Correlation Credit default Currency Dividend Equity Forex Inflation Interest rate Overnight indexed Total return Variance Volatility Year-on-Year Inflation-Indexed Zero-Coupon Inflation-Indexed.

Contango Currency future Dividend future Forward market Forward price Forwards pricing Forward rate Futures pricing Interest rate future Margin Normal backwardation Single-stock futures Slippage Stock market index future.

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative.

Time Value

Collateralized debt obligation CDO Constant proportion portfolio insurance Contract for difference Credit-linked note CLN Credit default option Credit derivative Equity-linked note ELN Equity derivative Foreign exchange derivative Fund derivative Interest rate derivative Mortgage-backed security Power reverse dual-currency note PRDC.

Consumer debt Corporate debt Government debt Great Recession Municipal debt Tax policy. Retrieved from " https: Articles needing additional references from September All articles needing additional references All articles with unsourced statements Articles with unsourced statements from August Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store.

Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 3 June , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. September Learn how and when to remove this template message. Terms Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.