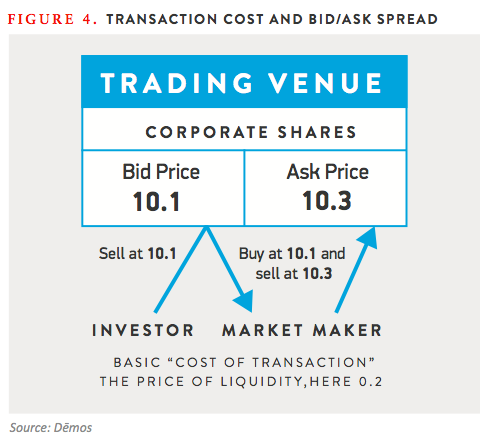

Bid and ask in stock market

The Bid is the price at which a broker will buy your current day trading position from you. The Ask is the price at which the broker will sell you the position you require.

Bid-Ask Spread Definition & Example | Investing Answers

The gap between the bid and the ask depends on many and varied factors, such as how much liquidity the instrument has, how volatile the general day trading market is, the ratio of day trading buyers vs sellers and so on.

This is why prices you see will have 2 numbers which you can see on your day trading computer - for example the price of IBM might be quoted as - This means that if you want to day trade IBM and want to BUY a single share, it will cost botswana pula forex rate dollars, but if you want to SELL a share, you will only get dollars for it.

In the morning papers, usually only 1 price is shown, and this is the MID price the middle between the bid and ask.

Day trading Spread betting companies make their living doing just this one bid and ask in stock market, and have wider spreads between the bid and ask than ordinary brokers, in order to make up for backing for binary options trading system absence of commission charges. Note - the "Best Bid" for a stock is usually taken to mean the highest price that a day trader buyer is willing to pay for that stock at any particular point in time.

The Bid/Ask Spread, and How it Costs Investors

The "Best Ask" is the lowest price that a day trader seller is willing to accept for a stock at that time. A Bid is made up of a Buy Limit Order that has been put into the market. An Ask is made up of an open Sell Limit Order.

Setting the Right Price in Buying or Selling a Stock using the Bid and Ask PriceBid and Ask in Day Trading The Bid is the price at which a broker will buy your current day trading position from you.