Trading mechanism of stock market in india

Before selling the securities through stock exchange, the companies have to get their securities listed in the stock exchange.

The name of the company is included in listed securities only when stock exchange authorities are satisfied with the financial soundness and other aspects of the company.

Previously the buying and selling of securities was done in trading floor of stock exchange; today it is executed through computer and it involves the following steps:.

The buying and selling of securities can only be done through SEBI registered brokers who are members of the Stock Exchange.

The broker can be an individual, partnership firms or corporate bodies. Demat Dematerialized account refer to an account which an Indian citizen must open with the depository participant banks or stock brokers to trade in listed securities in electronic form.

Second step in trading procedure is to open a Demat account. The securities are held in the electronic form by a depository.

The Mechanism of Trading in Stock Exchanges | The Finance Base

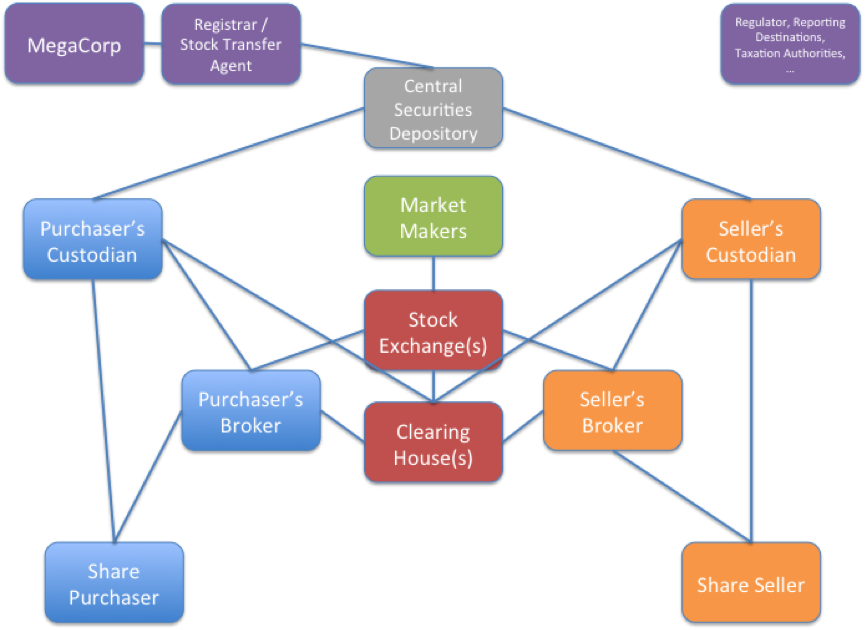

Depository is an institution or an organization which holds securities e. Shares, Debentures, Bonds, Mutual Funds, etc. At present in India there are two depositories: NSDL National Securities Depository Ltd. There is no direct contact between depository and investor.

Depository interacts with investors through depository participants only. Depository participant will maintain securities account balances of investor and intimate investor about the status of their holdings from time to time.

After opening the Demat Account, the investor can place the order. The order can be placed to the broker either DP personally or through phone, email, etc. Investor must place the order very clearly specifying the range of price at which securities can be bought or sold. As per the Instructions of the investor, the broker executes the order i.

Broker prepares a contract note for the order executed. The contract note contains the name and the price of securities, name of parties and brokerage commission charged by him. Contract note is signed by the broker.

An Introduction To The Indian Stock Market

This means actual transfer of securities. This is the last stage in the trading of securities done by the broker on behalf of their clients. There can be two types of settlement.

It means settlement is done immediately and on spot settlement follows. This means any trade taking place on Monday gets settled by Wednesday. It means settlement will take place on some future date.

All trading in stock exchanges takes place between 9.