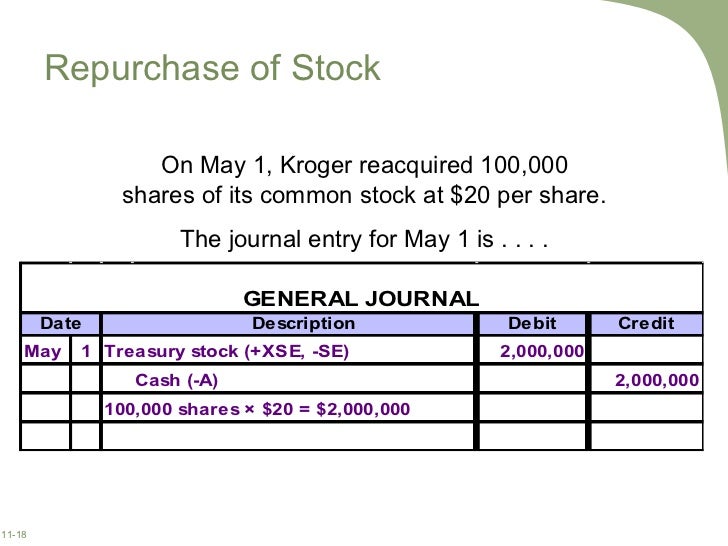

Journal entry for repurchase of common shares

Companies sometimes acquire their own shares of stock. Such shares may be used for employee incentive programs, future mergers with other companies, or for other reasons. In general, when a company acquires its own stock, its resources assets decrease and its sources of resources stockholders' equity decrease.

The specific accounts affected depend upon the type of stock purchased and what management intends to do with the shares. Reacquiring common stock When a company acquires its own common stock, it may either retire the shares or hold them for future use. To understand the effects of both options, it may be helpful to review three aspects of common stock. First, the total number of shares a company may issue, based on its articles of incorporation, is called its authorized shares.

Second, the total number of shares sold to owners is called issued shares. Third, the total number of shares in the hands of owners is called outstanding shares. As you will see in the following discussion of treasury stock, it is possible for a company's issued shares to differ from its outstanding shares.

At this point, however, assuming treasury stock does not exist, a company's issued shares will equal its outstanding shares and both will be less than its authorized shares.

For example, assume a company's articles of incorporation provide for the possibility of 40, common shares to be sold.

In such a case, the company's authorized common shares are 40, If 10, common shares are sold to owners, the company's issued shares become 10, If all 10, issued shares remain in the hands of owners, the company's outstanding shares are also 10, As a result, the company's authorized shares 40, are more than its issued shares 10, and outstanding shares 10, Note also that the number of issued shares 10, equals the number of outstanding shares 10, Retiring common stock When a company retires some of its common stock, it purchases them from owners and reduces the number of shares issued and the number of shares outstanding.

Such shares continue to be authorized shares and may be issued by the company again at a later date. The financial effects of a company retiring its own common stock, are a decrease in resources assets and an equal decrease in sources of resources stockholders' equity. Assets and stockholders' equity both decrease by the dollar amount the company pays to acquire the stock.

MIK Stock Price - Michaels Cos. Inc. Stock Quote (U.S.: Nasdaq) - MarketWatch

Sources of Borrowed Resources. Sources of Owner Invested Resources. Sources of Management Generated Resources.

Regardless of the specific accounts affected, the most important point of retiring common stock is the decrease in the company's resources and sources of resources. Managers are concerned about retiring stock because the process reduces the amount of resources they have to work with in the future. From an accounting standpoint, it is important to note that gains or losses are not recorded on the retiring of common stock.

Since such transactions do not involve customers, but are strictly transactions between the company and its owners, any "gains or losses" affect contributed capital or retained earnings and do not appear on the income statement. Treasury stock When a company acquires some of its own stock and holds it rather than retiring it, such shares are called treasury stock.

The shares continue to be authorized shares and may be used by the company again at a later date but they are not currently in the hands of owners. Although the treasury shares were authorized in the articles of incorporation and had been issued to owners, they are not outstanding because they are not being held by owners. Thus, when a company has treasury stock, its issued shares differ from its outstanding shares.

Since treasury stock shares are not in the hands of owners, such shares are not eligible to vote on any stockholders' issues, nor are such shares eligible to receive cash dividends. Many companies use treasury stock for employee stock purchase plans to provide incentives to employees.

The companies acquire their own shares, hold them until employees achieve certain goals, and then distribute the shares to employees. More advanced accounting courses will discuss the accounting for treasury stock and employee benefits.

The financial effects of a company acquiring its own common stock and holding it, are a decrease in resources assets and an equal decrease in sources of resources stockholders' equity.

The cash payment for the shares reduces the company's resources assets as the cash flows out to owners.

Notice the common stock account and additional paid-in capital, common stock account were not affected by the purchase of treasury stock.

This is because the common stock has not been retired. It was issued to owners, purchased by the company, and is still being held by the company. Notice, also, that the decrease in stockholders' equity was not shown in either the sources of owner invested resouces column or the sources of management generated resources column.

The actual stockholders' equity accounts ultimately affected by treasury stock depend upon the par value of the shares, the price at which the shares were originally issued to owners, the price paid by the company when it reacquired the shares, and the final use of the treasury stock by the corporation.

As long as the treasury stock is held by the corporation, the dollar amount of the treasury stock appears in the treasury stock account, which is reported as a separate account in stockholders' equity.

How to Account for Buyback of Shares | Finance - Zacks

The treasury stock account is a contra stockholders' equity account: It is usually the last stockholders' equity account on a company's balance sheet, as can be seen below. As of November 30, 6,, shares had been sold, 10, shares had been acquired by the company and retired, and 8, shares had been acquired by the company and were still being held. Issued shares are the number of shares sold but not retired. Issued shares include any shares being held as treasury stock.

On November 30, the Christopher Corporation's issued shares are 5,, 6,, shares sold - 10, shares retired. Calculate the Christopher Corporation's number of outstanding shares as of November Outstanding shares are shares sold to owners and still owned by them.

Treasury shares are not included in outstanding shares because they are not owned by stockholders. On November 30, the Christopher Corporation's outstanding shares are 5,, 5,, shares issued - 8, treasury shares. Calculate the number of common shares eligible to vote for the Christopher Corporation's board of directors and receive cash dividends as of November Only owners of outstanding shares are eligible to vote for the board of directors and receive cash dividends.

Retired shares and treasury shares do not have voting rights or rights to cash dividends. Reacquiring shares of stock Companies sometimes acquire their own shares of stock. Previous section Next section.

Treasury Stock Transactions - dummies

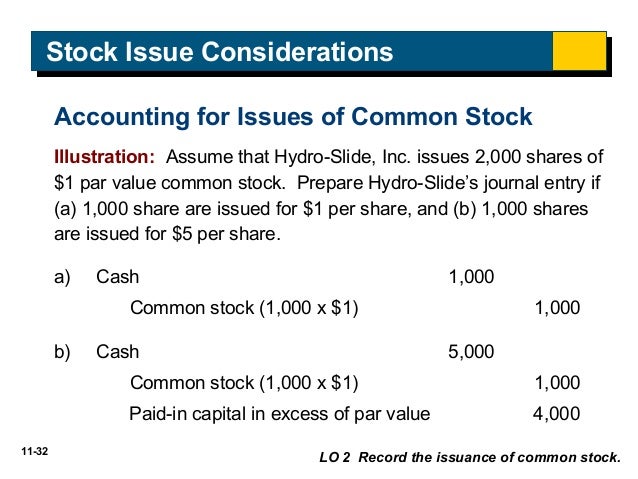

Additional Paid-in Capital, Common Stock. Additional Paid-in Capital, Preferred Stock. Treasury Stock, shares.