Incentive stock options tax withholding

Tax errors can be costly!

Don't draw unwanted attention from the IRS. Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated taxes, AMT, and more.

Unlike with NQSOs, with ISOs there is no federal income-tax withholding at exercise even with a same-day sale , and no Social Security and Medicare tax is owed or withheld.

Other than Pennsylvania, states follow these same rules. This does not mean you have no taxable income at exercise or sale.

Don’t Be Greedy When You Exercise Your Options - Consider Your Taxes

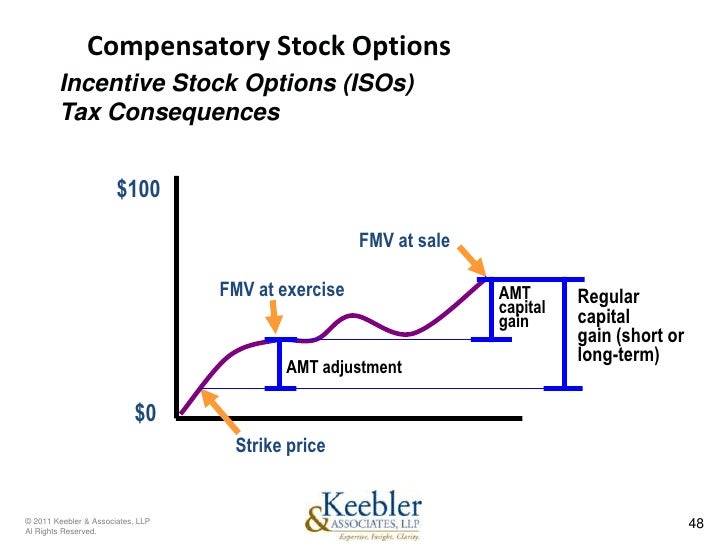

Rather, income tax is paid either when the return is filed or through estimated tax payments. For an annotated diagram of what will appear on your W-2 after you exercise incentive stock options, see a related FAQ.

The IRS was interested in this topic in the early s. But in the IRS decided to delay this change. Fortunately, the American Jobs Creation Act specifically excludes ISO and ESPP gains at exercise or sale from income tax withholding and from FICA Social Security and Medicare and FUTA taxes.

Ohio Department of Taxation > employer_withholding > faqs > employer_withholding

Accordingly, the IRS withdrew its proposed regulations in July Need a financial, tax, or legal advisor? Search AdvisorFind from myStockOptions.

Taxes What are the ISO withholding rules? You therefore need to plan for future taxes that you will owe with your return.

Consider putting aside the taxes you will owe, and also think about whether you need to make estimated tax payments. Past IRS Efforts To Tax ISOs The IRS was interested in this topic in the early s. Home My Records My Tools My Library.

Tax Center Global Tax Guide Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships.

Tax Topics - Topic Stock Options

Newsletter User Agreement Privacy Sitemap. The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions. Prior FAQ in list.

Next FAQ in list.