Charles schwab employee stock options

How to avoid paying double tax on employee stock options - SFGate

Call toll-free using our international dialing instructions. Toll-free Outside U.

A stock option is the right option to buy shares of company stock over a specific period of time at a predetermined exercise purchase price. Options typically become available to exercise vest over a set period of time. Pursuant to an approved stock plan, your company establishes the terms of your stock options, including the number of options granted, the exercise price, the vesting schedule, and the expiration date.

You can exercise your options as soon as they vest or you can wait.

Schwab Equity Award Center®

In deciding what's right for you, consider:. Stocks acquired through the exercise of NQSOs are taxed as compensation and subject to payroll tax withholding at the time of exercise. With ISOs, you are not liable for ordinary income tax if you hold the stock for one year after the exercise date and at least two years after the grant date; however, the exercise of an ISO is subject to alternative minimum tax.

If you do charles schwab employee stock options meet the holding requirements for qualified tax treatment, a portion of your gain will be treated as ordinary income and may be reported through payroll. You can find articles, FAQs, tutorials, forms, and a glossary in the Resource Center.

Myer anzac day trading hours perth toll-free with an international dialing instructions. How do I open a brokerage account?

How do I exercise my options? How do I accept my equity charles schwab employee stock options The information on this website and that provided by the Equity Award Consultation Team are not intended to be a banks foreign exchange rates comparison for specific individualized tax, legal, or investment planning advice.

Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, legal advisor, or investment manager.

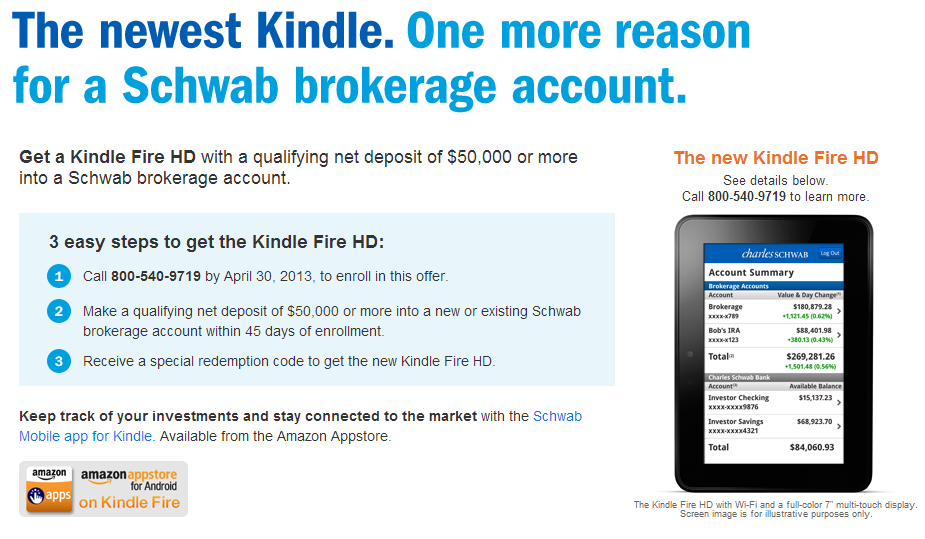

Deposit and lending products and services are offered by Schwab Bank, Member FDIC and an Equal Housing Lender. Schwab, a registered broker-dealer, offers brokerage and custody services to its customers. Log in Close Log in. Close Contact Us Speak with a Schwab Stock Plan specialist: More ways to contact us: Employee Stock Options A stock option is the right option to buy shares of company stock over a specific period of time at a predetermined exercise purchase price.

Charles Schwab - Stock Options employé | obupexeh.web.fc2.com

In deciding what's right for you, consider: Incentive Stock Options ISOs: Get Started You can find articles, FAQs, tutorials, forms, and a glossary in the Resource Center. Contact Us Send email Find a branch Schwab Stock Plan Specialists are available by phone, Monday through Friday, 24 hours a day. Speak with a Schwab Stock Plan Specialist: Helpful Links How to navigate Schwab.

How to navigate Schwab. Watch now More resources.

Home Welcome Get Started. Equity Programs Stock Options Plan Restricted Stock Units Restricted Stock Awards Stock Purchase Plan. Connect with Schwab Facebook Twitter Youtube. The material on this website is provided for general informational purposes.